Airdrop

First thing is first, you can check if you are eligible for the CRE airdrop with this calculator. Basically, it goes to ATOM stakers, with a bonus for those that voted on certain governance proposals (Prop 38 or 58), as well as those that used the Gravity Dex and provided liquidity there. The airdrop is split in two parts, with half to be available at launch, and half once the “Crescent Boost” feature is launched (whatever that may be), expected in the first half of this year. Claiming will require several tasks be completed, similar to various other Cosmos eco-system airdrops, most notably Osmosis.

Testnet

Very conveniently, the team behind Crescent have made public access to a testnet, so you can have a go and see what the platform will look like. I’d recommend anyone that qualifies for the airdrop to visit the testnet site and familiarize yourself in advance.

All of the following screenshots are taken from that site.

- The first thing to do is visit the Faucet buttons at the top right corner. This will give you some testnet tokens to play with. Once you have some funds (testnet, not real obviously) then you can have a play.

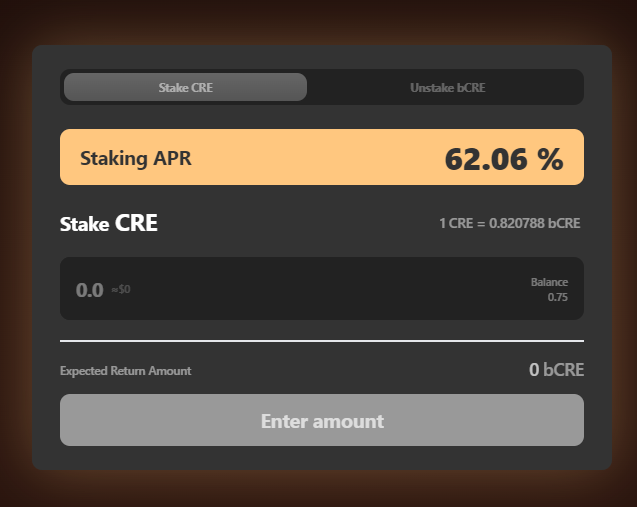

Staking

A visit to the Staking tab reveals the first difference between Crescent and other Cosmos IBC Dex’s. It appears that a big focus here will be on liquid staking – also known as staking derivatives. When you stake your CRE tokens, you receive bCRE in return. The staking yield in this screenshot should not be taken as what it will actually be, but it is likely to be high early on to bootstrap early participation.

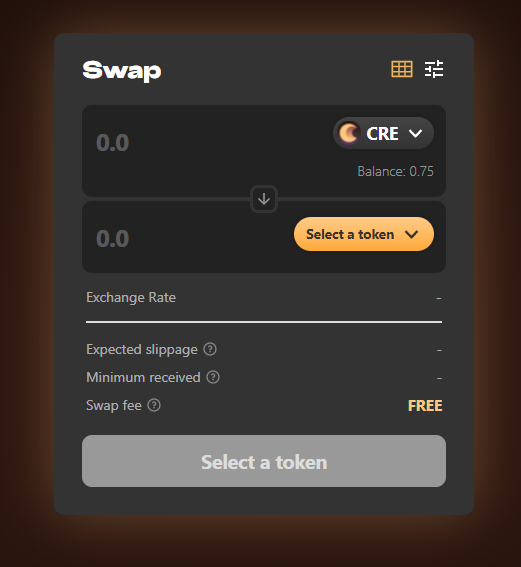

Swap

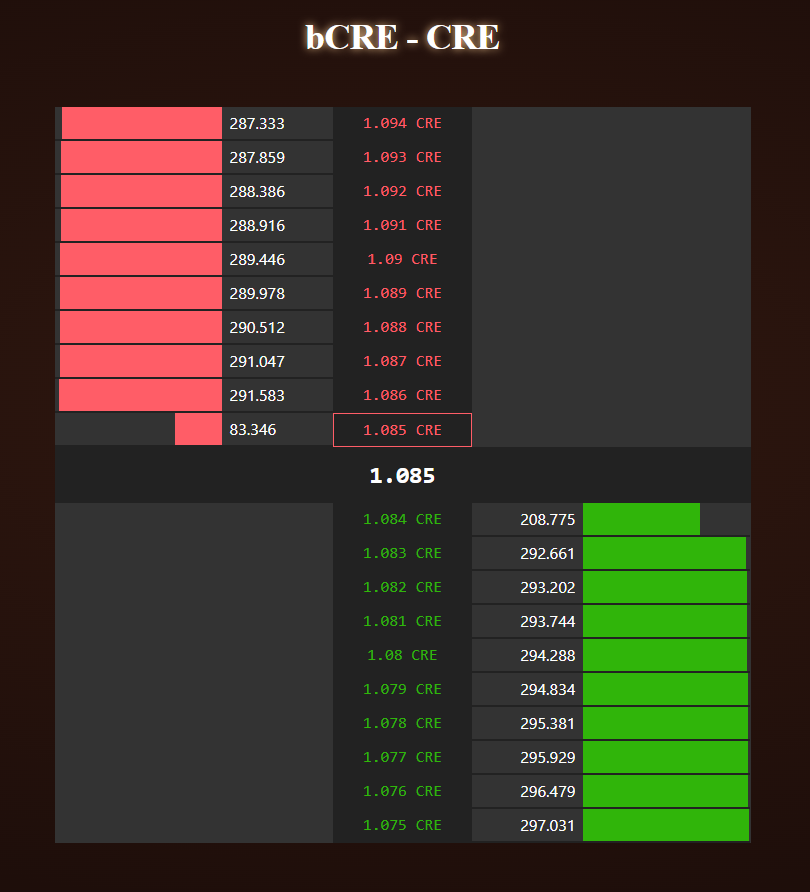

The core of any Dex, the swap page is like all others. Simple and clear. Drop downs list all tokens, and you can pick and choose from there. For those not familiar with IBC Dex’s, you have to deposit tokens from their native chains into your Crescent wallet to be able to swap them. One thing to do while here is check the two little icons at the top. One is the slippage tolerance settings like most Dex’s. But the other one is interesting. Clicking it brings up something like this:

It seems this is going to be a Dex with an orderbook. I guess that means you will be able to set limit orders for your swaps, which will be an interesting addition. I’m unsure on this testnet how to do so, the swap UI does not seem to have this feature as far as I can see. Maybe it is an advanced feature not ready yet? Anyway, it is good to see that this Dex will have some unique features, and not just be a clone of Osmosis.

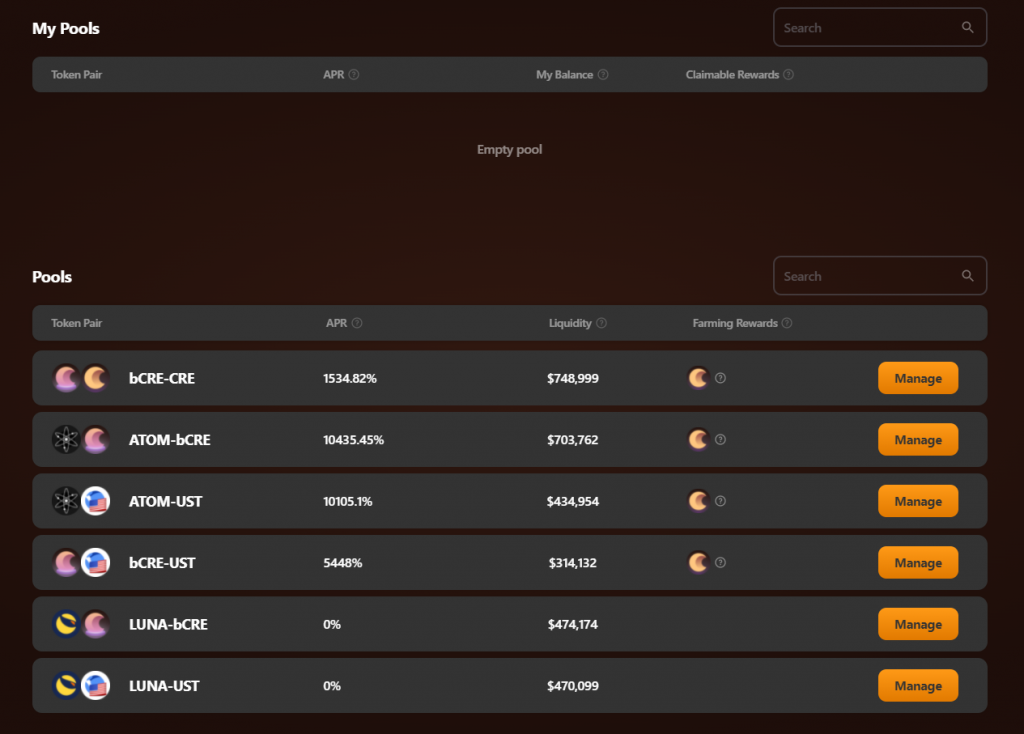

Farm

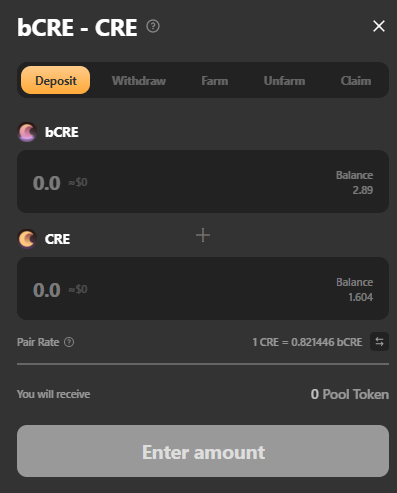

So here we get down to business, the LP and yield farming section. When you click on manage for your chosen farm, then you get a pop-up showing the options.

Adding an LP position is first, and then in a separate step you need to deposit using the “farm” tab to get the juicy APR’s. Unlike Osmosis, there is no time period bonding, and you can remove your liquidity in a similar two step process. “Unfarm” and then “Withdraw”. The claim button lastly would be to claim your farming rewards, and it appears that it will be a similar epoch based system of daily rewards like Osmosis, rather than continuously accruing.

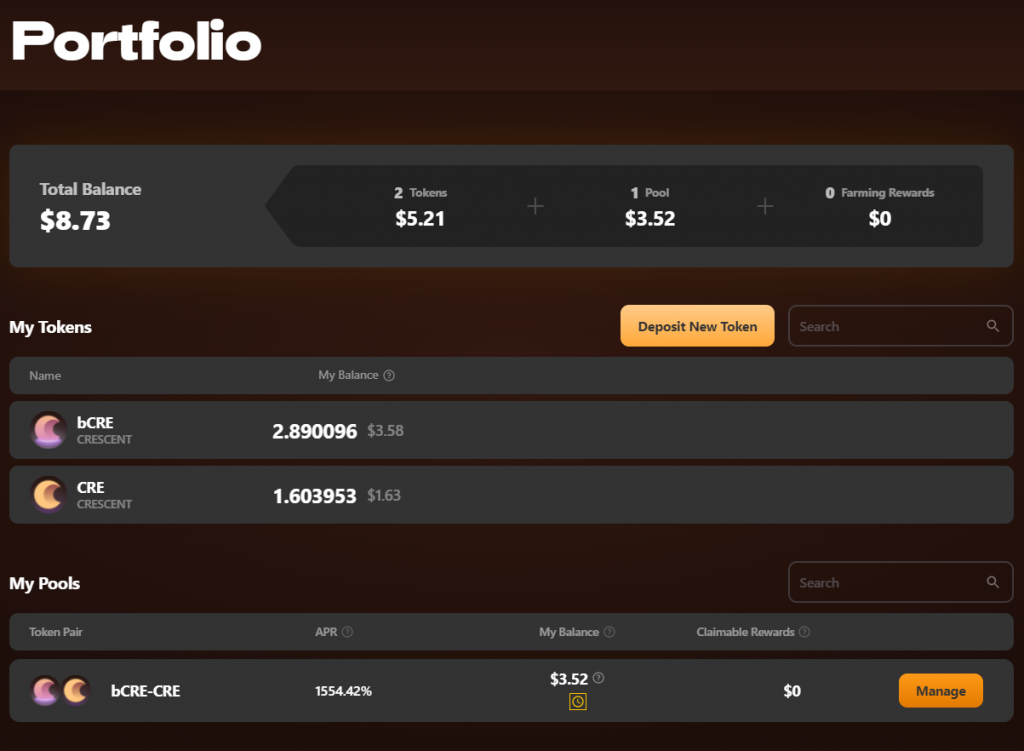

Portfolio

The last tab is a portfolio view. It is quite nice, and shows all tokens in your wallet (only the Crescent wallet, not across all chains), along with any pool positions you have. Nice and clear and easy to track everything on one page. This is a helpful and quite nice UI.

From here, you can also manage your tokens and deposit tokens from other linked chains (via IBC), and also manage pools you are in from here